Best Cheap Stocks To Sell Covered Calls

In theory, a stock could crash 15% and you’d experience that entire loss. Your best bet for finding the best stocks for covered calls is to limit your selection to those stocks that pay zero or small dividends, or else make sure you time the dividend cycle so that you have no short call positions at distribution.

If you’re in a hurry, below are our top picks for the best stocks for covered call writing:

Best cheap stocks to sell covered calls. About options and am thinking about writing covered calls against some of the stocks in my portfolio. The underlying stock, the term, and the strike. Every covered call trade involves three decisions:

World’s biggest package delivery company. Top stocks to buy in 2021. $128 call for a net debit of $4.95.

You must own at least 100 shares of a stock to write one covered call. Each contract is worth <$500 and premiums are decent. If you get assigned shares then you can sell a covered call against them.

Potential drawback of selling covered calls against your stocks. Walmart’s stock price never closed below triple digits and demonstrated good support ahead of the psychological $100 level that can help protect a. 48 rows a covered call is a financial market transaction in which the seller of call options.

Largest electric transmission network in the u.s. Stock market insights & financial analysis, including free earnings call transcripts, investment ideas and etf & stock research written by finance experts. (~3% return per contract so far)

Selling a put exposes you to 100% downside risk. You should be able to sell a contract for less than $2 in commissions, and sometimes a lot cheaper than that. If ohi closes above $39.00 per share on march 15, then we’ll keep our $0.53 in call premiums (or $53 per contract because they come in lots.

Berkshire stock may be the perfect stock for covered calls. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. The higher the dividend payout, the more of a drag that dividend will be on the premium income you'll receive selling calls.

If you don’t get assigned you pocket the premium. One of the best, and most popular approaches, especially among investors that don’t consider themselves ‘option traders,’ is the covered call strategy. Currently doing this with at&t

Depending on your investment goals, there are many ways to select each. For a free trial to the best trading community on. The premiums aren’t gigantic, but if the stock isn’t called away, then that premium you just sold could be.

Sell an otm put (cash covered preferred) sell covered calls if assigned; Good stocks to write covered calls against include those whose stock price is between $5 and $20 a share. Robinhood is a great app thats lets you invest in stocks.

(if you are paying $2. Stock market insights & financial analysis, including free earnings call transcripts, investment ideas and etf & stock research written by finance experts. $120 call while selling the aug.

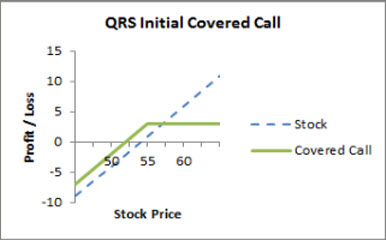

Long stock + short call = covered call. These are two dividend stock examples that are some of the best stocks to write covered calls against. In this video i will talk about what i look for when selling covered calls, from dividends to what.

Selling naked puts all on its own can be a very risky endeavor depending on how you’re managing the position. Obviously, if the stock is a $50 stock, you must pay $5,000 to buy the stock, as opposed to only $1,000 for a $10 stock.

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Posting Komentar untuk "Best Cheap Stocks To Sell Covered Calls"